Sign up for our eBlog

Receive a FREE Coupon for $1,000 off Real Estate Sales Closing Costs.

This was given to me by the six year old daughter of a prospective Chula Vista property management client.

If you know of anyone we could help, please give me a call on my cell phone 619-316-4242…Larry Breitfelder Navas.

Strong Chula Vista Sales Market Continues

By Larry Breitfelder Navas

Partner, Golden State Property Management

June 24, 2015

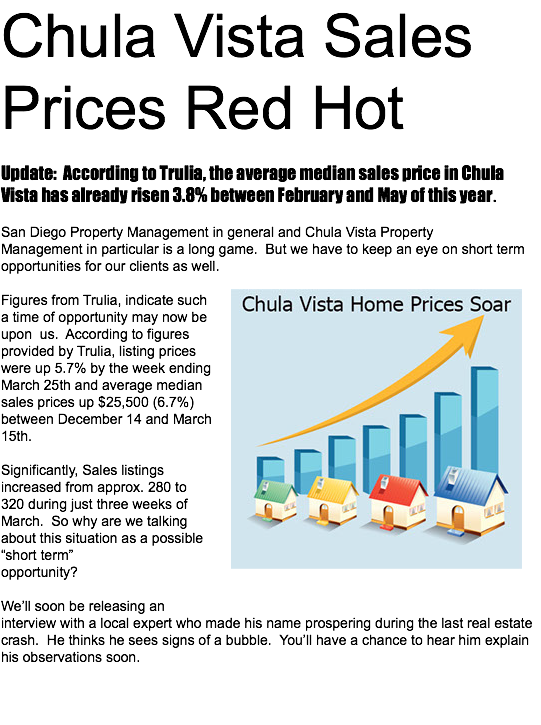

As expressed by Trulia: "The median sales price for homes in Chula Vista CA for Mar 15 to Jun 15 was $417,500. This represents an increase of 3.1%, or $12,500, compared to the prior quarter and an increase of 4.4% compared to the prior year. Sales prices have appreciated 30.5% over the last 5 years in Chula Vista. The average listing price for Chula Vista homes for sale on Trulia was $533,521 for the week ending Jun 10, which represents an increase of 0.9%, or $4,616, compared to the prior week and an increase of 6.2%, or $30,940, compared to the week ending May 20... Popular neighborhoods in Chula Vista include Otay Ranch Village, Eastlake Greens, Rolling Hills Ranch, Eastlake, Eastlake Land Swap, and Sunbow".

$417,500. This represents an increase of 3.1%, or $12,500, compared to the prior quarter and an increase of 4.4% compared to the prior year. Sales prices have appreciated 30.5% over the last 5 years in Chula Vista. The average listing price for Chula Vista homes for sale on Trulia was $533,521 for the week ending Jun 10, which represents an increase of 0.9%, or $4,616, compared to the prior week and an increase of 6.2%, or $30,940, compared to the week ending May 20... Popular neighborhoods in Chula Vista include Otay Ranch Village, Eastlake Greens, Rolling Hills Ranch, Eastlake, Eastlake Land Swap, and Sunbow".

It is significant to note that the largest strides in value were experienced by properties with a smaller number of bedrooms. This is reflected in the price per square foot of Chula Vista residential real estate increasing over 7% in contrast to the 4.4% overall price increase.

The contrast between this enjoyable continuing short term trend and some disturbing long term fundamentals can be perplexing. Some of the explanation may exist in supply side of the "supply and demand" economic dynamic. According to Trulia, since May 20, 2015 - the number of home listings in the market has declined almost 9%.

We hope these market updates are helpful in planning your strategy for San Diego property management and investing.

Activists Want to End Landlord Protection

By Larry Breitfelder Navas

Partner, Golden State Property Management

July 16, 2015

In certain fundamental respects, San Diego property management and investment is like New York property management and Biloxi property management. So much of it is about protecting client cash flow and long term profitability.

client cash flow and long term profitability.

During the 1970’s California home values were skyrocketing as did the associated property tax burden. Governments were thrilled with the extra income, but many people in California were in danger of losing their homes.

The public rebelled by passing Proposition 13. Prop 13 limited property taxes to 1% of assessed value at the time of property transfer and escalation with increased value limited to 2% per year until the next change of ownership. The new tax liability also being limited to 2% annual growth.

“Reformers” believe that long term property owners – especially landlords - are being subsidized by newer residents. By various formulas, they want to roll back prop. 13.

At a deep level, many believe that whatever level protection resident owners enjoy, landlords deserve much less. They do not see beyond the “Simon LeGreed” stereotype.

Many political activists and elected officials do not understand the sacrifices necessary to acquire rental property, its importance to the financial security of investors and the ongoing challenges of owning rental property.

We would all be wise to keep an eye out for California elected officials flirting with the idea of “reforming” prop 13. It should be made clear that such a position would not go unpunished.

619.500.3374

Home

Why Are Billionaires Investing More in Real Estate?

By Larry Breitfelder Navas

Partner, Golden State Property Management

February 28, 2015

San Diego Property Management and Investment is a local activity that takes place in the widest possible context. San Diego is a world class city after all and its market is significantly influenced by worldwide investment trends.

In fact, as a group, the world’s largest investors (those who have investments of $30 million or more in play) are putting a greater share of their wealth in real estate. During the 2008 to 2012 period, large deal real estate investment rose from 146 to 308 billion (a 111% increase). In contrast, corporate investment only rose 43% to a total of $594 billion.

large deal real estate investment rose from 146 to 308 billion (a 111% increase). In contrast, corporate investment only rose 43% to a total of $594 billion.

Such investment trends are of more than academic interest. The great majority of us who are far less fortunate investors should take note because the big investors have the potential to drive up real estate values in the areas they favor.

It is largely thanks to the new found wealth in Asia that we have such a dramatically increased volume of investment to take note of. However its motivation and the disproportionate share of resources invested has been more a matter of culturally based desire to diversify and better secure this new wealth.

The outsize potential of Asian investment has become obvious. At a time when the Chinese are being exposed to stories about real estate selling in Detroit selling for the price of a pair of shoes –Wealthy Asians as a group have put 28%of their resources in real estate vs. 6% by similarly rich North Americans and 8% by the same cohort in Europe.

We would all be wise to keep an eye on the geographic reach of Asian investment. According to the most recent statistics, Asians have up to this point invested 95% \of their real estate money in cities.

With experience and satisfaction of initial expatriate demand for personal residences, there is likely to be a gradual shift of emphasis into suburbs and waterfront property. The impact of those dollars promise to be significant. Especially for those with a vested interest in suburban and waterfront oriented San Diego Property Management and Investment.

Time to Raise Rents in San Diego?

San Diego property managers and landlords just have to love it. Most rental surveys show that rents in San Diego increased 3-6% over the last year. A lot of that has to do with 41,000 new local jobs that in many cases were well paying positions in biotech, engineering and professional services. Partly this was due to a pace of new building that has reportedly been running at about half the level necessary to accommodate increased population.

been running at about half the level necessary to accommodate increased population.

As enjoyable for property owners as this trend is, its sustainability can be questioned. In contrast to rents, general inflation in San Diego was only about 1.3% during the last half of 2014. Even more significant, average wage growth for the last year was approximately 2% - as little as half to a third the rental increase.

When rents go up beyond the ability of tenants to pay, occupancy goes down. Essentially more people doubling up like we see during recessions. According to one of the most reputable local sources, the San Diego occupancy rate has dropped to 95.9% from 97.3% last year. Still above the traditional average of 95%, but the trend is troublesome.

An intelligent strategy may be to raise rents now, and in the not too likely event average rents decline severely - consider reversing the rent increases of this time to keep good tenants. I don't think anyone has ever resented a landlord for lowering rent.

In the meantime, enjoy the additional revenue and always feel welcome to call me directly at 619-316-4242 if you want to chat.

Best Regards,

Larry Breitfelder Navas

Partner

Golden State Property Management

Golden State Property Management Now Guarantees Rent

Larry Breitfelder Navas

Partner 6/05/15

Athough being a San Diego landlord is good business, we recognize that it is often not easy. Accumulating enough capital to acquire rental property is a big challenge all by itself. Then there are the demands of maintenance, fluctuating rental markets and the ongoing headache of potential legal problems.

Landlords deserve as much peace of mind as they can get. To this end Golden State has initiated a program to offer clients the deposit of their rental income into their bank accounts on the first of the month - every month.

Although we are the only company we know of that offers a guaranteed rent program, it really is not much of a risk for us. We have a 0% eviction rate because we are in the habit of collecting rents. So we feel very good about this chance to help landlords sleep easier.

If you know anyone who would benefit from San Diego property management in general and guaranteed rent in particular - I would appreciate it if you would let that person know that they can call me directly at 619-316-4242.

Best Regards,

Larry Breitfelder Navas

Partner

San Diego Real Estate Market Sailing into a "Perfect Storm"?

A successful Sales Broker and Partner at Golden State who made his name during the foreclosure crisis explains why he sees a "double dip" coming and suggests ways we all can maximize our profit from real estate sales and investment - in both good times and bad.

Call Golden State at 619-500-3374 for further details.

Larry Breitfelder-Navas

An example of the video tours we are doing to advertise our vacancies